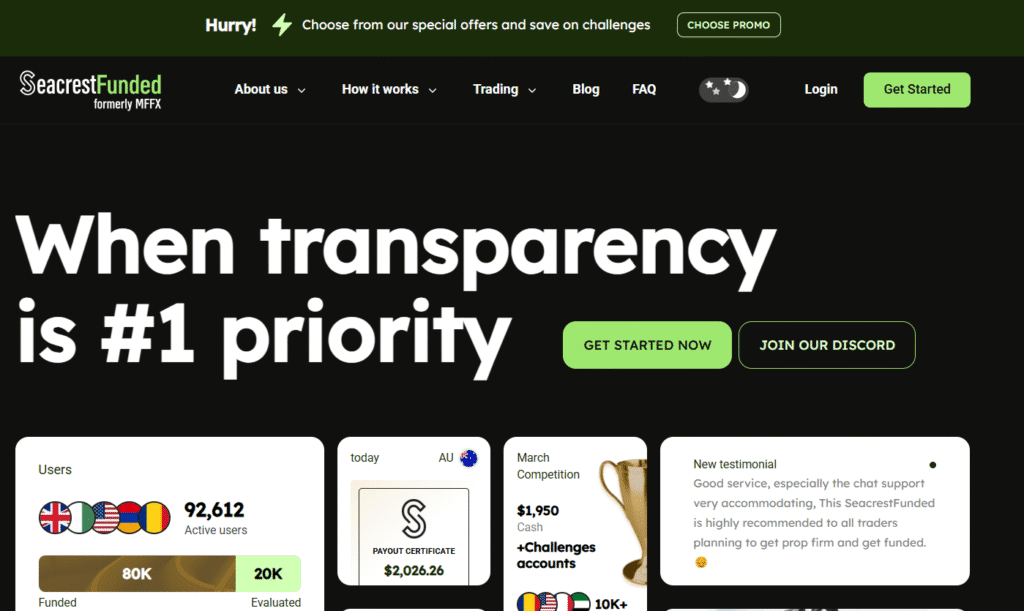

Seacrest Funded – Firm Review

- Immediate capital access post evaluation

- Swift payouts without bureaucratic delays

- Elite trading desk support provided

- Minimal restrictions on trading styles

- Expansive market choices available now

Company Overview

Seacrest Funded is a modern proprietary trading firm that provides traders with access to funded trading accounts. The company stands out with its two-phase evaluation process designed to identify disciplined and consistent traders. Seacrest offers both Standard and Professional Challenge programs, allowing traders of various experience levels to demonstrate their skills before accessing funded accounts.

What makes Seacrest Funded particularly attractive is its commitment to trader-friendly policies, including reasonable profit targets, realistic drawdown limits, and competitive profit splits. The firm supports various account sizes ranging from $10,000 to $200,000, making it accessible to traders at different stages of their journey. With its focus on multiple financial markets and support for popular trading platforms like MetaTrader 4 and MetaTrader 5, Seacrest Funded creates an environment where skilled traders can scale their earnings without risking their own capital.

Key Features at a Glance

Challenge Fees

- Standard Challenge – One-time fee starting at $99 for $10,000 account, scaling up based on account size

- Professional Challenge – One-time fee starting at $199 for $10,000 account, offering more flexibility for experienced traders

- Reset Fee – Discounted fee to restart a challenge if trading objectives aren’t met

- Free Retake – Available if you reach at least 50% of the profit target before violating a rule

Account Types

- Standard Challenge: Two-phase evaluation with 8% profit target in both phases, suitable for most traders

- Professional Challenge: Accelerated program with 10% profit target, designed for experienced traders who need fewer restrictions

- Funded Account: Live trading account with real capital after successfully passing both evaluation phases

Profit Split Options

- Initial Split: 80/20 profit split (80% to trader, 20% to firm) after completing both challenge phases

- Scaling Plan: Potential to increase to 90/10 split after consistent profitable performance

- Performance Bonuses: Additional incentives for exceptional trading performance over extended periods

Account Sizes

- $10,000: Entry-level account with lowest challenge fee, ideal for beginners

- $25,000: Mid-sized account balancing affordability with trading capacity

- $50,000: Popular choice offering substantial capital for serious traders

- $100,000: Professional-level account for experienced traders with proven strategies

- $200,000: Maximum account size for elite traders seeking significant profit potential

Trading Platforms

- MetaTrader 4 (MT4): Industry-standard platform with extensive charting capabilities and support for EAs

- MetaTrader 5 (MT5): Advanced platform offering more timeframes, analytical tools, and access to a wider range of markets

- Custom Dashboard: Proprietary trading interface for monitoring account metrics and performance

Financial Markets

- Forex: Major, minor, and exotic currency pairs with competitive spreads

- Commodities: Gold, silver, oil, and other raw materials traded as CFDs

- Indices: Major global stock indices including S&P 500, NASDAQ, FTSE, and more

- Cryptocurrencies: Bitcoin, Ethereum, and other major cryptocurrencies as CFDs

Challenge Programs Detail

Standard Challenge

| Feature | Challenge Phase | Verification Phase |

|---|---|---|

| Duration | 30 days | 60 days |

| Profit Target | 8% | 8% |

| Daily Drawdown | 5% | 5% |

| Maximum Drawdown | 10% | 10% |

| Minimum Trading Days | 5 days | 10 days |

Professional Challenge

| Feature | Challenge Phase | Verification Phase |

|---|---|---|

| Duration | 30 days | 30 days |

| Profit Target | 10% | 5% |

| Daily Drawdown | 5% | 5% |

| Maximum Drawdown | 10% | 10% |

| Minimum Trading Days | 3 days | 5 days |

Challenge Specifications

- Max Allocation: Up to $1,000,000 for exceptional traders through the scaling program

- Scaling: Account size can double after every 10% profit with consistent performance

- Trading Competitions: Monthly competitions with cash prizes for top-performing traders

- Free Trial: 7-day demo challenge available to test the platform before purchasing

- Profit Targets: 8% target for Standard Challenge, 10% for Professional Challenge in phase one

- Drawdown Structure:

- Daily: 5% maximum loss from previous day’s closing balance

- Maximum: 10% maximum loss from initial account balance

- Trailing: Not implemented, fixed maximum drawdown only

Trading Rules and Requirements

- No weekend holding for forex pairs, but indices and cryptos can be held

- No news trading during major economic announcements

- Maximum leverage of 1:100 for forex, 1:20 for indices and commodities

- Minimum 5 trading days required during challenge phase

- No hedging or martingale strategies permitted

- Position holding time minimum of 2 minutes to prevent scalping

- Expert Advisors (EAs) are allowed but must follow all trading rules

Company Information

- Founded in 2020, headquartered in London, UK

- Regulated by the Financial Conduct Authority (FCA)

- 24/7 customer support via live chat, email, and phone

- Educational resources including webinars, trading guides, and market analysis

- Active community of over 15,000 traders worldwide

Payout Methods

- Bank Transfer (3-5 business days)

- PayPal (1-2 business days)

- Skrill (24-48 hours)

- Bitcoin and other cryptocurrencies (24 hours)

- Minimum payout amount: $50

- Bi-weekly profit distribution schedule

Trading Commissions

- Forex: $7 per lot round-turn (Standard), $5 per lot round-turn (Professional)

- Indices: $10 per lot round-turn

- Commodities: $10 per lot round-turn

- Cryptocurrencies: 0.05% of trade value

- No commission on funded account profits

IP Rules

- Trading from one consistent IP address/location recommended

- Maximum of 3 different IP addresses permitted

- VPN usage allowed but must be declared beforehand

- Account sharing strictly prohibited

- Multiple logins from different locations simultaneously not permitted

Video Review

Seacrest Funded Review

Comprehensive review of Seacrest Funded trading services

Unique Features

Trader Support

- One-on-one coaching sessions with professional traders

- Weekly market analysis webinars for funded traders

- Trading psychology workshops to improve discipline

- Advanced trading tools and indicators package

Account Management

- Real-time performance dashboard

- Mobile app for tracking account metrics

- Risk management tools with automatic notifications

- Detailed trade analysis and reporting

Why Choose Seacrest Funded?

Seacrest Funded stands out in the competitive prop trading landscape by offering a balanced combination of trader-friendly conditions and professional risk management. Their evaluation process is designed to be challenging yet achievable, focusing on consistent profitability rather than unrealistic performance metrics.

Key advantages include:

- Rapid funding process with potential to receive funded account within 30 days

- Generous profit splits starting at 80% for traders

- Scaling program allowing successful traders to manage up to $1M

- Bi-weekly payouts with multiple withdrawal options

- Comprehensive educational resources and professional support

- Transparent fee structure with no hidden costs

- Free retake opportunity if 50% profit target is reached

There are no reviews yet.