Oanda Prop Trader – Firm Review

- Trusted global currency exchange leader

- Cutting-edge trading tech since 1996

- Transparent rates with premier execution

- Superior education for market success

- Award-winning analysis tools available

Company Overview

Oanda Prop Trader is a well-established global financial services company founded in 1996, with a strong reputation in the forex and CFD trading space. In recent years, Oanda Prop Trader has expanded its offerings to include a prop trading program called PropTrader, designed to identify and fund talented traders. What sets Oanda Prop Trader apart is its combination of institutional credibility with innovative prop trading solutions. The company leverages its deep market expertise and robust infrastructure to provide traders with excellent execution, competitive spreads, and access to multiple financial markets. Oanda’s prop trading program follows a two-phase evaluation process where traders must demonstrate consistent profitability and risk management before receiving funding. With regulated operations in major financial centers worldwide, including the US, UK, Canada, Japan, and Australia, Oanda Prop Trader brings institutional-grade legitimacy to the prop trading sector, making it an attractive option for traders seeking funding from a globally recognized brand.

Key Features at a Glance

Challenge Fees

- Standard Challenge – One-time fee ranging from $90 to $990 depending on account size

- Professional Challenge – One-time fee ranging from $135 to $1,485 for accelerated funding process

- Installment Option – Available for larger account sizes, allowing traders to split the challenge fee

- Reset Fee – Discounted fee if you need to restart a failed challenge

Account Types

- Standard Challenge: Suitable for beginners and methodical traders with a 30-day time limit for each phase

- Professional Challenge: Designed for experienced traders with more aggressive profit targets but higher payouts

- Funded Account: Upon successful completion of both challenge phases, traders receive a live funded account

Profit Split Options

- Standard Split: 80/20 profit split with 80% going to the trader

- Scaling Plan: Initial 80% profit split with potential increases to 90% based on consistent performance

- Monthly Payouts: Regular profit distributions on a monthly basis

Account Sizes

- $10,000: Entry-level account with manageable challenge fee and profit targets

- $25,000: Mid-tier account with balanced risk-reward profile

- $50,000: Advanced account size for experienced traders

- $100,000: Professional account size with substantial earning potential

- $200,000: Large-scale account for high-volume trading

Trading Platforms

- MetaTrader 4 (MT4): Industry-standard platform with robust charting and automation capabilities

- MetaTrader 5 (MT5): Advanced platform with additional features and market access

- OANDA Trade: Proprietary platform with institutional-grade execution and analysis tools

- Mobile Trading: Dedicated apps for iOS and Android devices

Financial Markets

- Forex: Access to over 70 currency pairs with competitive spreads

- Commodities: Trading in gold, silver, oil, and other key commodity markets

- Indices: Major global stock indices including S&P 500, NASDAQ, and DAX

- Bonds: Government bond futures and related instruments

- Cryptocurrencies: Select crypto CFDs for diversified trading options

Challenge Programs Detail

Standard Challenge

| Feature | Challenge Phase | Verification Phase |

|---|---|---|

| Duration | 30 Days | 30 Days |

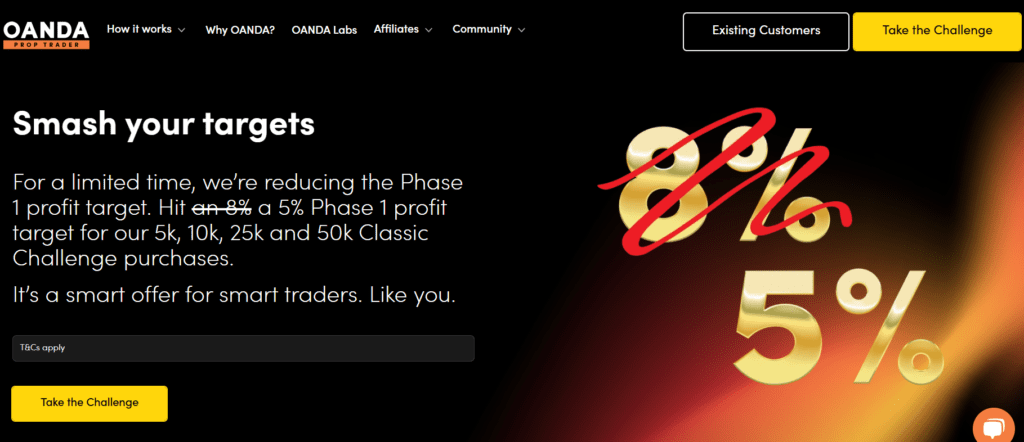

| Profit Target | 8% | 5% |

| Daily Drawdown | 5% | 5% |

| Maximum Drawdown | 10% | 10% |

| Minimum Trading Days | 10 Days | 10 Days |

Professional Challenge

| Feature | Challenge Phase | Verification Phase |

|---|---|---|

| Duration | No limit | No limit |

| Profit Target | 12% | 8% |

| Daily Drawdown | 5% | 5% |

| Maximum Drawdown | 10% | 10% |

| Minimum Trading Days | 5 Days | 5 Days |

Challenge Specifications

- Max Allocation: Up to $200,000 for initial funded accounts with potential scaling

- Scaling: Account size can be increased by up to 25% after every 3 consecutive profitable months

- Trading Competitions: Regular competitions with additional cash prizes for top-performing traders

- Free Trial: 7-day demo account available to test the platform before committing to a challenge

- Profit Targets: Realistic targets ranging from 5-12% depending on challenge type and phase

- Drawdown Structure:

- Daily: 5% maximum loss allowed within a single trading day

- Maximum: 10% total account drawdown from starting balance

- Trailing: Not implemented – drawdowns calculated from initial balance only

Trading Rules and Requirements

- No overnight holding of positions during major news events

- Maximum position size limited to 5% of account equity

- No excessive use of leverage (maximum 1:100)

- Weekend holding of positions is permitted except before major economic releases

- Hedging is allowed but subject to reasonable use policy

- Automated trading and EAs are permitted but must be pre-approved

- No trading during low-liquidity market conditions

- Minimum of 5-10 trading days required per phase (varies by program)

Company Information

- Founded: 1996, with PropTrader program launched in 2021

- Headquarters: New York, with offices in London, Toronto, Singapore, Sydney, and Tokyo

- Regulation: Regulated by multiple tier-1 authorities including FCA (UK), ASIC (Australia), CFTC (US)

- Proprietary Capital: Trading with the firm’s own capital, not client funds

- Customer Support: 24/5 via live chat, email, and phone

- Educational Resources: Comprehensive learning center with webinars, videos, and articles

Payout Methods

- Bank Wire Transfer (3-5 business days)

- PayPal (1-2 business days)

- Skrill (1 business day)

- Neteller (1 business day)

- Bitcoin and other cryptocurrencies (1-2 business days)

Trading Commissions

- Forex: Commission-free with competitive spreads starting from 0.7 pips

- Commodities: Commission-free with spreads from 0.3 points on gold

- Indices: Commission-free with spreads from 0.8 points on major indices

- Cryptocurrencies: Fixed commission of 0.5% per trade

- Overnight Financing: Standard swap rates applied for positions held overnight

IP Rules

- One IP address per trader – multiple accounts from the same IP require prior approval

- VPN usage is generally prohibited during trading

- Location changes must be reported to account management

- Mobile trading is permitted across different networks

- Account sharing is strictly prohibited and will result in immediate termination

Video Review

Oanda Review

Comprehensive review of Oanda Prop Trader services

Unique Features

Institutional Grade Technology

- Advanced execution engine with 99.9% uptime

- Proprietary market data feeds from tier-1 liquidity providers

- Low-latency trading infrastructure with globally distributed servers

- Advanced risk management system with real-time monitoring

Trader Support

- Personal account manager for funded traders

- Advanced performance analytics and reporting tools

- Community trading floor with weekly strategy sessions

- Professional development program with experienced mentors

Why Choose Oanda Prop Trader?

Oanda Prop Trader stands out in the prop trading landscape by combining the credibility of a well-established, regulated forex broker with innovative prop trading opportunities. Their approach balances achievable trading targets with professional trading conditions that appeal to both developing and experienced traders.

Key advantages include:

- Regulated institutional background providing security and transparency

- Competitive challenge fees with reset discounts if needed

- Reliable and prompt profit distributions on a monthly basis

- Scaling program allowing account growth up to 4x the initial size

- Extensive educational resources and community support

- Advanced trading technology with institutional-grade execution

- Wide range of tradable markets across multiple asset classes

There are no reviews yet.