TradeDay – Elite Prop Firm Review

- Elite market access for everyone

- Swift capital allocation after evaluation

- Exceptional backtesting tools included free

- Mentors guide your trading journey

- Custom metrics track your progress

- Get up tp 30% Discount on your challenges with this code: OPSODO

Firm Overview

TradeDay is an innovative proprietary trading firm that offers traders the opportunity to access substantial capital through its challenge programs. Founded with the vision of empowering both novice and experienced traders, TradeDay provides a structured pathway to trading with significant financial backing without requiring traders to risk their own capital.

The firm stands out with its two-phase evaluation process—Challenge and Verification—designed to identify disciplined traders who can consistently generate profits. TradeDay offers multiple account sizes ranging from $10,000 to $200,000, accommodating various trading styles and experience levels.

What sets TradeDay apart is its trader-friendly conditions, including competitive profit splits of up to 90%, one-step evaluation options, and access to multiple financial markets including forex, commodities, indices, and stocks. Their platform supports various trading styles and strategies while maintaining clear rules to ensure trading integrity and risk management.

Key Features at a Glance

Challenge Fees

- Standard Challenge – One-time fee starting from $99 for $10,000 account, with traditional two-phase evaluation

- Professional Challenge – One-time fee starting from $199 for $10,000 account, offering more flexible trading conditions

- Fast-Track Option – Premium fee that allows traders to skip directly to funded account upon meeting criteria

- Reset Fee – $49-$99 to restart a challenge if account rules are violated

Account Types

- Standard Account: Traditional two-phase evaluation with 10% profit target in each phase, daily drawdown limit of 5%, and maximum drawdown of 10%

- Professional Account: Enhanced flexibility with 8% profit target, 6% daily drawdown limit, and 12% maximum drawdown

- Funded Account: Live trading account with real capital after passing evaluation phases, with 80-90% profit split

- Demo Account: Free trial account available to test trading conditions before purchasing a challenge

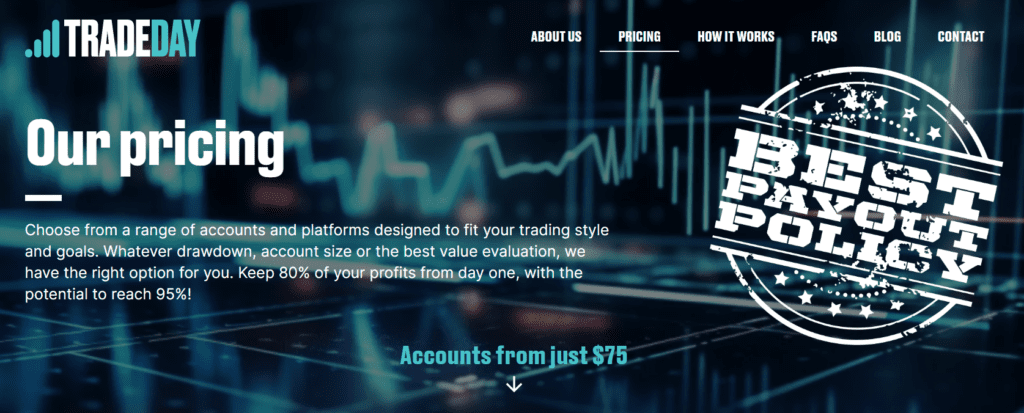

Profit Split Options

- Standard Split: 80% trader / 20% company – Default profit-sharing arrangement for new funded traders

- Performance-Based Scale: Up to 90% for traders who maintain consistent profitability over multiple months

- Volume-Based Incentives: Additional percentage points for traders who maintain high trading volume with quality execution

- Loyalty Program: Increased profit share for traders who remain with the firm for extended periods

Video Review

TradeDay – Elite Prop Firm Review

TradeDay – Elite Prop Firm Review

Account Sizes

- $10,000: Entry-level account with $99-$199 challenge fee, ideal for beginners or conservative traders

- $25,000: Mid-sized account with $199-$299 challenge fee, suitable for traders with some experience

- $50,000: Advanced account with $299-$399 challenge fee, designed for experienced traders

- $100,000: Professional account with $499-$599 challenge fee, for serious traders with proven track records

- $200,000: Elite account with $799-$999 challenge fee, for expert traders managing significant capital

Trading Platforms

- MetaTrader 4: Industry-standard platform with comprehensive charting tools, technical indicators, and automated trading support

- MetaTrader 5: Advanced version with additional timeframes, indicators, and multi-asset trading capabilities

- TradingView: Web-based platform with superior charting capabilities and social trading features

- cTrader: Professional ECN trading platform with depth of market visibility and advanced order types

Financial Markets

- Forex: 50+ currency pairs including majors, minors, and exotics with competitive spreads

- Indices: Major global stock indices including S&P 500, NASDAQ, Dow Jones, DAX, and FTSE

- Commodities: Energy products (oil, natural gas), precious metals (gold, silver), and agricultural products

- Stocks: Hundreds of US and international equities from major exchanges

- Crypto CFDs: Major cryptocurrencies including Bitcoin, Ethereum, and Litecoin

Challenge Programs Detail

Standard Challenge

| Feature | Challenge Phase | Verification Phase |

|---|---|---|

| Duration | No time limit | No time limit |

| Profit Target | 10% | 5% |

| Daily Drawdown | 5% | 5% |

| Maximum Drawdown | 10% | 10% |

| Minimum Trading Days | 10 days | 10 days |

Professional Challenge

| Feature | Challenge Phase | Verification Phase |

|---|---|---|

| Duration | No time limit | No time limit |

| Profit Target | 8% | 4% |

| Daily Drawdown | 6% | 6% |

| Maximum Drawdown | 12% | 12% |

| Minimum Trading Days | 8 days | 8 days |

Challenge Specifications

- Max Allocation: Initial funding up to $200,000 with potential to scale to $1,000,000 based on performance

- Scaling: 25% account growth for each consistent period of profitability (typically quarterly); double account size after reaching specific milestones

- Trading Competitions: Monthly challenges with additional cash prizes for top-performing traders

- Free Trial: 7-day demo account available to test trading conditions before purchasing a challenge

- Profit Targets: Standard Challenge requires 10% profit in first phase, 5% in second; Professional Challenge requires 8% profit in first phase, 4% in second

- Drawdown Structure:

- Daily: 5% limit in Standard Challenge, 6% in Professional Challenge

- Maximum: 10% limit in Standard Challenge, 12% in Professional Challenge

- Trailing: Applied once account reaches 5% profit, protecting gains from significant reversals

Trading Rules and Requirements

- No overnight holding of positions during high-impact news events

- Maximum allowed leverage varies by account size (up to 1:100 for smaller accounts)

- No hedge trading or arbitrage strategies allowed

- Minimum 10 trading days required in Standard Challenge (8 days for Professional)

- Maximum daily lot size limits based on account size

- No expert advisors or automated trading during challenge phases

- Trading hours restricted to official market hours for each instrument

- No same-direction scaling into positions that increases risk beyond allowed limits

Company Information

- Founded in 2020 by a team of professional traders and financial market specialists

- Headquartered in London with additional offices in New York and Singapore

- Regulated by financial authorities with full compliance with international trading standards

- 24/5 customer support available via live chat, email, and phone

- Educational resources including webinars, trading guides, and strategy sessions

- Active community of over 25,000 traders worldwide

Payout Methods

- Bank Wire Transfer (3-5 business days)

- PayPal (1-2 business days)

- Skrill (24-48 hours)

- Neteller (24-48 hours)

- Bitcoin and other cryptocurrencies (1-24 hours)

- Wise (formerly TransferWise) (2-3 business days)

Trading Commissions

- Forex: $5 per lot round turn ($2.5 per side)

- Indices: $4 per lot round turn

- Commodities: $3-$6 per lot round turn depending on the instrument

- Stocks: 2 cents per share with $1 minimum

- Crypto CFDs: 0.1% of trade value

- No hidden fees or markups on spread

IP Rules

- One IP address per trader account

- VPN usage prohibited during challenge and verification phases

- IP location must match registered country of residence

- IP changes must be approved by support team before trading

- Multiple logins from different locations may trigger security verification

- Travel exceptions available with prior notification to support team

Unique Features

Trader Development Program

- One-on-one coaching with professional traders

- Weekly strategy sessions and market analysis

- Performance analytics dashboard with trade statistics

- Trading psychology workshops

Technical Advantages

- Low-latency execution with institutional-grade infrastructure

- Advanced trading journal integration

- Custom indicators and strategy templates

- Mobile trading app with full functionality

- Real-time trade monitoring and analysis

Why Choose TradeDay?

TradeDay stands out in the competitive prop firm landscape by offering a balanced combination of trader-friendly conditions and professional-grade resources. Their evaluation process is designed to be challenging yet achievable, identifying traders with consistent strategies rather than lucky gamblers.

Key advantages include:

- Higher profit splits (up to 90%) compared to industry standard

- No time limits on completing challenges

- Transparent rules with no hidden conditions

- Multiple account sizes to suit different trading styles

- Rapid scaling program for successful traders

- Comprehensive educational resources and trader support

- Fast and reliable payouts with multiple payment methods

- Professional trade execution with minimal slippage

vorbelutrioperbir –

Hi, I think your site might be having browser compatibility issues. When I look at your blog site in Safari, it looks fine but when opening in Internet Explorer, it has some overlapping. I just wanted to give you a quick heads up! Other then that, wonderful blog!