Prop365

- Massive capital expansion for traders

- Straightforward path to consistent income

- Fast daily settlement of profits

- Personalized guidance for optimal results

- Expert backing throughout trading journey

Company Overview

Prop365 is a modern proprietary trading firm that offers traders the opportunity to trade with substantial capital without risking their own money. Founded with the mission to empower traders globally, Prop365 provides a comprehensive evaluation process that tests trading discipline and skill before granting access to funded accounts. The company stands out for its two-phase challenge program: Standard and Professional, designed to accommodate traders at different skill levels. With competitive profit splits, multiple account size options, and support for various financial markets, Prop365 creates an accessible pathway for traders looking to scale their operations professionally. Their transparent evaluation process and clear trading rules focus on risk management and consistent profitability, making it suitable for both novice traders looking to establish themselves and experienced professionals seeking larger capital allocations.

Key Features at a Glance

Challenge Fees

- Standard Challenge – One-time fee based on account size, starting from $99 for smaller accounts

- Professional Challenge – Premium option with higher fees but faster evaluation process and more favorable trading conditions

- Reset Fee – Discounted fee to restart a challenge after failing to meet requirements

- Special Promotions – Occasional discounts and promotional pricing for new traders

Account Types

- Challenge Account: Initial evaluation phase where traders must demonstrate profitable trading while adhering to risk parameters

- Verification Account: Second phase with identical rules to further validate consistent trading performance

- Funded Account: Final phase where successful traders manage real capital with profit-sharing arrangements

- Demo Account: Practice environment available for traders to test strategies before entering official challenges

Profit Split Options

- Standard Split: 80/20 profit sharing arrangement (80% to the trader, 20% to Prop365)

- Professional Split: 90/10 profit sharing for Professional challenge graduates

- Scaling Plan: Profit split percentage increases based on consistent performance and account growth

- Instant Withdrawals: Profit withdrawals available with quick processing times

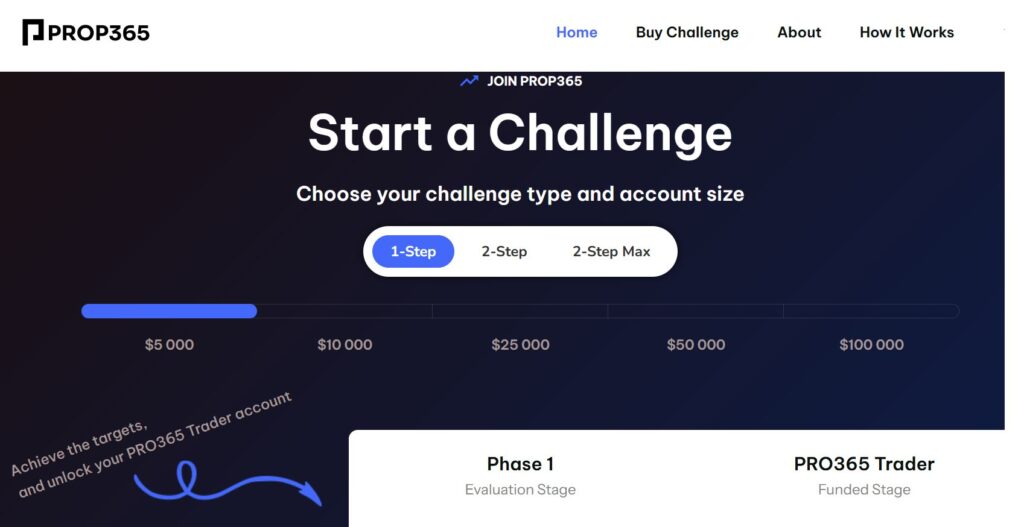

Account Sizes

- $10,000: Entry-level account with lowest challenge fee, ideal for beginners

- $25,000: Mid-sized account with balanced risk parameters

- $50,000: Advanced account for experienced traders with higher profit potential

- $100,000: Professional-grade account for serious traders

- $200,000: High-capacity account for elite traders with proven track records

Trading Platforms

- MetaTrader 5 (MT5): Comprehensive platform with advanced charting tools and automated trading capabilities

- MetaTrader 4 (MT4): Classic platform with widespread use and extensive indicator library

- TradingView: Web-based platform with social features and versatile charting options

- Custom Dashboard: Proprietary platform for tracking performance metrics and challenge progress

Financial Markets

- Forex: Major, minor, and exotic currency pairs with competitive spreads

- Indices: Global market indices including US30, S&P 500, NASDAQ, and international options

- Commodities: Access to gold, silver, oil, and other popular commodity markets

- Cryptocurrencies: Major cryptocurrency pairs with extended trading hours

- Stocks: Selected stocks from major global exchanges

Challenge Programs Detail

Standard Challenge

| Feature | Challenge Phase | Verification Phase |

|---|---|---|

| Duration | Up to 30 days | Up to 60 days |

| Profit Target | 8% | 5% |

| Daily Drawdown | 5% | 5% |

| Maximum Drawdown | 10% | 10% |

| Minimum Trading Days | 10 days | 10 days |

Professional Challenge

| Feature | Challenge Phase | Verification Phase |

|---|---|---|

| Duration | Unlimited | Unlimited |

| Profit Target | 10% | 5% |

| Daily Drawdown | 5% | 5% |

| Maximum Drawdown | 10% | 10% |

| Minimum Trading Days | 5 days | 5 days |

Challenge Specifications

- Max Allocation: Successful traders can manage up to $400,000 in capital after proving consistent performance

- Scaling: Accounts can scale up to 25% after every three profitable months with consistent performance

- Trading Competitions: Monthly competitions with additional cash prizes for top-performing traders

- Free Trial: 7-day demo account available to test the platform before committing to a challenge

- Profit Targets: Reasonable profit targets designed to identify disciplined trading rather than excessive risk-taking

- Drawdown Structure:

- Daily: 5% maximum loss allowed in a single trading day based on initial balance

- Maximum: 10% total drawdown limit from the initial account balance

- Trailing: No trailing drawdown, making it easier for traders to manage risk parameters

Trading Rules and Requirements

- No hedging allowed within the same asset class

- Weekend holding of positions is permitted except for specific high-volatility assets

- Minimum 10 trading days required during challenge phase

- Maximum daily loss limit of 5% must be observed

- No expert advisors or automated trading allowed during evaluation phases

- News trading is permitted but with caution during major economic releases

- Consistent trading style must be maintained throughout challenge and verification

- Overnight fees and commissions are factored into profit calculations

Company Information

- Founded: 2019

- Headquarters: London, United Kingdom

- Regulatory Status: Operates under UK financial regulations

- Trading Hours: 24/5 for most markets

- Customer Support: Available via live chat, email, and phone 24/5

- Educational Resources: Webinars, trading guides, and strategy videos provided free

- Community: Active Discord community with over 15,000 traders

Payout Methods

- Bank Transfer (2-3 business days)

- PayPal (1-2 business days)

- Wise (1-2 business days)

- Bitcoin and other cryptocurrencies (Same day processing)

- Skrill (1 business day)

- Minimum withdrawal amount: $50

- Monthly payout schedule: 1st-5th of each month

Trading Commissions

- Forex pairs: $7 per lot round turn

- Indices: $7-$10 per lot depending on the specific index

- Commodities: $7-$12 per lot based on the specific commodity

- Cryptocurrencies: 0.05% per side

- Overnight swap rates apply for positions held beyond daily cutoff

- No hidden fees or markup on spreads

IP Rules

- One IP address per trader allowed during challenge phases

- VPN usage is prohibited during evaluation

- Multiple accounts from the same location require prior approval

- Location changes must be notified to support in advance

- Mobile trading allowed but with consistent device usage

- IP verification required before first withdrawal

Video Review

Prop365 Review

Comprehensive review of Prop365 trading services

Unique Features

Trader Support

- Dedicated account manager for funded traders

- Weekly performance analysis and coaching

- Trade psychology workshops and mentoring

- Community trading sessions with professional analysts

Technology

- Proprietary performance tracking dashboard

- Advanced risk management tools and analytics

- Mobile app for monitoring account status

- Real-time trade statistics and benchmark comparisons

Why Choose Prop365?

Prop365 stands out in the competitive prop trading landscape by offering a balanced combination of trader-friendly conditions and professional capital management. Their platform is designed to identify and nurture real trading talent while maintaining sustainable risk protocols.

Key advantages include:

- Straightforward two-phase evaluation with clear, achievable targets

- Generous profit splits starting at 80% for traders

- No trailing drawdown rules, making risk management more straightforward

- Scaling plan that allows traders to increase their capital allocation over time

- Fast verification processing – typically within 24-48 hours of completing challenges

- Comprehensive educational resources and community support

- Regular payouts with multiple withdrawal options

- Responsive customer service with personalized support for funded traders

There are no reviews yet.