OFP Funding – Firm Review

- Swift payments within two business days

- Realistic profit objectives for traders

- Expert assistance whenever you need

- Personalized coaching for continuous improvement

- Multiple account choices meets needs

Company Overview

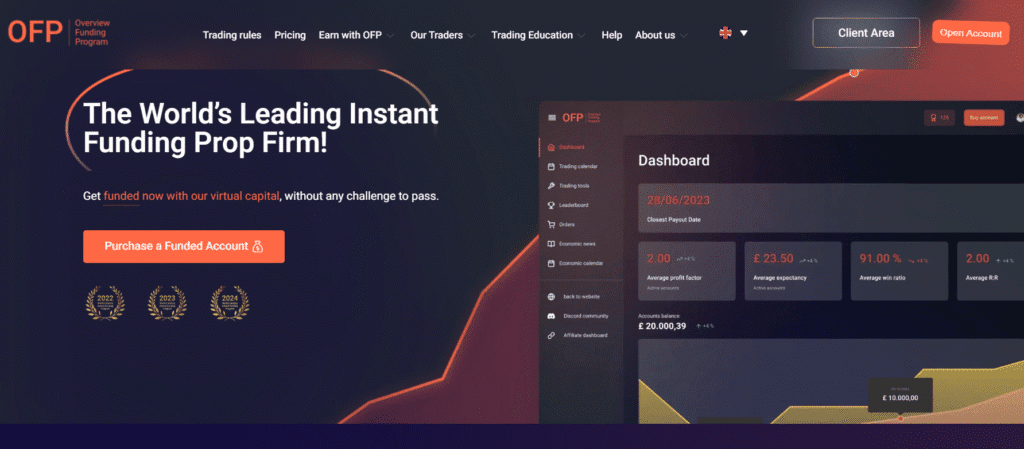

OFP Funding is an innovative proprietary trading firm that provides aspiring traders with access to substantial capital without requiring them to risk their own money. Founded with the mission to empower traders worldwide, OFP Funding offers a structured path to becoming a funded trader through challenge programs that assess trading skill and discipline. The company stands out for its competitive fee structure, generous profit splits, and comprehensive trading platform options. With both Standard and Professional challenge tracks, OFP Funding caters to traders of various experience levels, offering account sizes ranging from $10,000 to $200,000. Their evaluation process is designed to identify disciplined traders who can maintain consistent profitability while adhering to risk management rules—ultimately creating a partnership that benefits both the trader and the firm.

Key Features at a Glance

Challenge Fees

- One-time payment – Single upfront fee for account access with no monthly payments

- Discount options – Regular promotional offers and discounts available for new traders

- Scale-based pricing – Lower percentage fees for larger account sizes

- Reset fee – Affordable option to restart your challenge if initially unsuccessful

Account Types

- Standard Challenge: Two-phase evaluation with balanced profit targets and risk parameters, ideal for developing traders

- Professional Challenge: Accelerated two-phase evaluation with more aggressive profit targets, designed for experienced traders

- Funded Account: Live trading account awarded after successfully passing both evaluation phases

Profit Split Options

- Standard Split: 80% trader/20% firm – The default profit-sharing arrangement for funded traders

- Scaling Program: Up to 90% trader/10% firm – Increased profit split based on consistent performance milestones

- Instant Withdrawals: Rapid payout processing for eligible traders

Account Sizes

- $10,000: Entry-level account with accessible challenge fee, perfect for beginners

- $25,000: Mid-tier account balancing affordability with meaningful trading capital

- $50,000: Popular option offering substantial capital for experienced traders

- $100,000: Professional-grade account for serious traders seeking significant returns

- $200,000: Maximum account size providing elite traders with substantial capital potential

Trading Platforms

- MetaTrader 4: Industry-standard platform with powerful charting and analysis tools

- MetaTrader 5: Advanced platform offering enhanced features and additional timeframes

- TradingView: Web-based platform with social features and advanced charting capabilities

Financial Markets

- Forex: Major, minor, and exotic currency pairs with competitive spreads

- Indices: Global stock indices including US, European, and Asian markets

- Commodities: Energy, precious metals, and agricultural products

- Cryptocurrencies: Major digital currencies with 24/7 trading availability

Challenge Programs Detail

Standard Challenge

| Feature | Challenge Phase | Verification Phase |

|---|---|---|

| Duration | No time limit | No time limit |

| Profit Target | 8% | 5% |

| Daily Drawdown | 5% | 5% |

| Maximum Drawdown | 10% | 10% |

| Minimum Trading Days | 10 days | 10 days |

Professional Challenge

| Feature | Challenge Phase | Verification Phase |

|---|---|---|

| Duration | No time limit | No time limit |

| Profit Target | 12% | 8% |

| Daily Drawdown | 5% | 5% |

| Maximum Drawdown | 10% | 10% |

| Minimum Trading Days | 10 days | 10 days |

Challenge Specifications

- Max Allocation: Up to $400,000 after successfully scaling through the program

- Scaling: 25% account growth after each quarter of consistent profitability

- Trading Competitions: Monthly contests with additional cash prizes and account upgrades

- Free Trial: 3-day demo period to test the platform and trading conditions

- Profit Targets: Milestone-based with no daily or weekly targets, only overall phase goals

- Drawdown Structure:

- Daily: 5% maximum loss from account balance at start of trading day

- Maximum: 10% total drawdown from initial balance

- Trailing: No trailing drawdown – fixed maximum from starting balance

Trading Rules and Requirements

- Weekend holding positions are allowed with no restrictions

- News trading is permitted, but proper risk management is required

- No minimum trading days per week, but 10 active trading days required during each phase

- No overnight restrictions – positions can be held for multiple days

- No restrictions on trading styles (scalping, day trading, swing trading all allowed)

- EAs and automated strategies are permitted with prior approval

- No lot size restrictions beyond appropriate risk management parameters

Company Information

- Founded in 2019 by a team of professional traders and financial experts

- Headquartered in London with regional offices in Singapore and New York

- Regulated by financial authorities with proper risk management protocols

- 24/7 customer support via live chat, email, and phone

- Active community with over 15,000 traders worldwide

- Educational resources including webinars, trading guides, and market analysis

Payout Methods

- Bank Wire Transfer (3-5 business days)

- Bitcoin and other cryptocurrencies (24 hours)

- PayPal (1-2 business days)

- Skrill (1-2 business days)

- Neteller (1-2 business days)

Trading Commissions

- Forex: $7 per lot (standard) round turn

- Indices: $7 per lot round turn

- Commodities: $7 per lot round turn

- Cryptocurrencies: 0.05% per side

- No hidden fees or additional charges

IP Rules

- VPN usage is prohibited during trading

- Maximum of 3 registered IP addresses allowed per account

- IP changes must be reported to support at least 24 hours in advance

- All devices must be registered before trading

- Travel notifications required when trading from new locations

Video Review

OFP Funding Review

Comprehensive review of OFP Funding trading services

Unique Features

Trader Support

- One-on-one coaching sessions with professional traders

- Weekly market analysis and trading ideas

- Discord community with dedicated support channels

- Performance analytics dashboard for tracking progress

Trading Conditions

- Raw spreads starting from 0.0 pips

- No restrictions on trading strategies or styles

- Advanced order types including OCO and trailing stops

- No time limit to complete challenges

- Instant account setup after payment

Why Choose OFP Funding?

OFP Funding stands out in the competitive prop firm landscape by offering a trader-centric approach that prioritizes realistic trading conditions and sustainable growth. Unlike many competitors, OFP focuses on identifying genuinely skilled traders rather than collecting evaluation fees.

Key advantages include:

- No time limits on completing challenges, allowing for proper strategy execution

- Generous 80/20 profit split with scaling opportunities up to 90/10

- Flexible trading rules that accommodate various trading styles

- Comprehensive educational resources and community support

- Transparent fee structure with no hidden costs

- Rapid verification and funding processes

- Regular account scaling to reward consistent performance

There are no reviews yet.