Maven Trading

- Elite mentorship from profitable experts

- Superior training beyond basic courses

- Custom indicators for market advantage

- Practical education with real scenarios

- Community support during trading journey

Company Overview

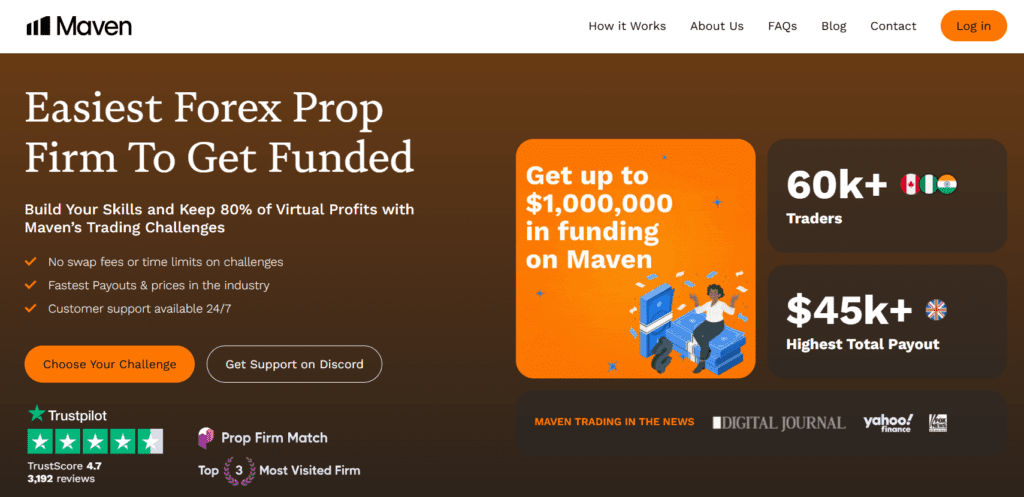

Maven Trading is a modern proprietary trading firm that offers funded trading accounts to qualified traders worldwide. Founded with the mission to provide accessible trading capital to talented traders, Maven stands out for its straightforward challenge structure and transparent rules. The company offers both Standard and Professional challenge paths, catering to traders of various experience levels and trading styles. Maven’s platform particularly shines with its competitive profit splits, ranging from 70% to 90%, and account sizes from $5,000 to $200,000. Their evaluation process is designed to identify disciplined traders who can manage risk effectively while generating consistent profits. With a focus on forex, indices, commodities, and cryptocurrencies, Maven provides comprehensive trading opportunities across multiple markets using popular platforms like MetaTrader 4 and 5. The firm is known for its responsive customer support and educational resources that help traders succeed in their funding journey.

Key Features at a Glance

Challenge Fees

- Standard Challenge – One-time fee starting from $97 (for $5K account) to $1,097 (for $200K account)

- Professional Challenge – One-time fee starting from $127 (for $5K account) to $1,397 (for $200K account)

- Reset Fee – 50% of the original challenge fee if you fail and want to restart

- Refund Policy – 70% refund available if you fail the challenge within the first 7 days

Account Types

- Standard Challenge: 2-phase evaluation with 8% profit target in each phase, suitable for consistent traders

- Professional Challenge: Accelerated 2-phase evaluation with 12% profit target in each phase, designed for aggressive traders

- Funded Account: Real account with firm capital after successfully passing both challenge phases

- Demo Account: Practice accounts available for testing strategies before taking the challenge

Profit Split Options

- Standard Split: 70% for traders on initial funded accounts

- Scaling Split: Up to 90% profit split after consistent performance milestones

- Consistency Bonus: Additional 5% profit split for traders maintaining consistent performance over 3+ months

- First Withdrawal: Free first withdrawal with each cycle, standard fees apply for subsequent withdrawals

Account Sizes

- $5,000: Entry-level account with lowest challenge fee, perfect for beginners

- $10,000: Popular starter account balancing affordability and trading capital

- $25,000: Mid-tier account for intermediate traders with established strategies

- $50,000: Advanced account for experienced traders seeking higher profit potential

- $100,000: Professional-level account for high-volume traders

- $200,000: Maximum account size for expert traders with proven track records

Trading Platforms

- MetaTrader 4 (MT4): Classic platform with extensive technical analysis tools and indicators

- MetaTrader 5 (MT5): Advanced platform with additional timeframes, indicators, and market depth

- TradingView Integration: Charts and analysis tools from TradingView available for strategy development

- Mobile Trading: Full mobile support for both MT4 and MT5 platforms on iOS and Android

Financial Markets

- Forex: Over 50 currency pairs including majors, minors, and exotics

- Indices: Major global stock indices including S&P 500, NASDAQ, DOW, DAX, and more

- Commodities: Energy, metals, and agricultural products including gold, silver, oil, and natural gas

- Cryptocurrencies: Major crypto pairs including Bitcoin, Ethereum, and other top digital assets

Challenge Programs Detail

Standard Challenge

| Feature | Challenge Phase | Verification Phase |

|---|---|---|

| Duration | 30 days | 60 days |

| Profit Target | 8% | 8% |

| Daily Drawdown | 5% | 5% |

| Maximum Drawdown | 10% | 10% |

| Minimum Trading Days | 10 days | 10 days |

Professional Challenge

| Feature | Challenge Phase | Verification Phase |

|---|---|---|

| Duration | 30 days | 60 days |

| Profit Target | 12% | 12% |

| Daily Drawdown | 5% | 5% |

| Maximum Drawdown | 10% | 10% |

| Minimum Trading Days | 10 days | 10 days |

Challenge Specifications

- Max Allocation: Up to $200,000 initial account size with potential to scale up to $1,000,000 after consistent performance

- Scaling: 25% account growth after every 10% profit achieved in funded accounts, with reset profit targets

- Trading Competitions: Monthly challenges for funded traders with additional cash prizes and account upgrades

- Free Trial: 7-day demo account available to test platform and rules before purchasing a challenge

- Profit Targets: 8% for Standard Challenge, 12% for Professional Challenge in both evaluation phases

- Drawdown Structure:

- Daily: 5% maximum loss from account balance at start of trading day

- Maximum: 10% overall account drawdown from initial balance

- Trailing: No trailing drawdown (only fixed from starting balance)

Trading Rules and Requirements

- Minimum 10 trading days required in each phase

- Maximum position size of 5% of account balance

- News trading allowed with appropriate risk management

- Weekend holding permitted for certain instruments (excluding high-volatility pairs)

- No maximum daily profit cap or consistency rules

- EAs and automation allowed but must be disclosed

- No prohibited trading strategies except arbitrage and latency exploitation

- Trading hours: 24/5 for forex, crypto, and indices (according to market hours)

Company Information

- Founded in 2020 by a team of professional traders and fintech specialists

- Based in London, UK with global operations

- Supports traders from over 150 countries worldwide

- Registered company with full regulatory compliance

- 24/7 customer support via live chat, email, and ticketing system

- Educational resources including webinars, trading guides, and strategy sessions

Payout Methods

- Wire Transfer (3-5 business days)

- Cryptocurrency (Bitcoin, Ethereum, USDT) (1-24 hours)

- PayPal (1-2 business days)

- Wise (1-3 business days)

- Minimum payout amount: $100

- Bi-weekly payout schedule available for consistent traders

Trading Commissions

- Forex: Standard institutional spread + $5 per lot round turn

- Indices: Variable spread based on market conditions, no additional commission

- Commodities: $4 per lot round turn + tight institutional spreads

- Cryptocurrencies: 0.05% per trade with low spreads

- No hidden fees or additional charges during trading

IP Rules

- One IP address allowed per trader (multiple accounts from same location permitted)

- VPN usage allowed but must be registered with Maven support

- Travel notifications required when changing trading locations

- IP changes permitted with prior notification to support team

- Multiple traders in same household must register accounts together

Video Review

Maven Review

Comprehensive review of Maven trading services

Unique Features

Trading Flexibility

- No minimum trading days requirement after becoming funded

- No time constraints to reach profit targets in funded accounts

- Weekend holding allowed for most instruments

- News trading permitted with proper risk management

Scaling Program

- Automatic account scaling up to $1,000,000

- Progressive profit split increases with consistent performance

- Multiple accounts option for diversifying strategies

- Faster scaling path for Professional Challenge graduates

Why Choose Maven?

Maven Trading stands out in the crowded prop firm landscape by offering a trader-centric approach with transparent rules and reasonable targets. Their focus on long-term trader success rather than challenge failures sets them apart from many competitors.

Key advantages include:

- Generous profit splits up to 90% with consistent performance

- Clear, straightforward rules without hidden conditions

- No time pressure to reach profit targets in funded accounts

- Flexible trading conditions allowing various strategies

- Responsive customer support and trading community

- Competitive challenge fees relative to account sizes

- Rapid account scaling program with reasonable milestones

- Educational resources to help traders succeed

admin –

Awesome platform.