Sure Leverage Funding – Firm Review

- Superior capital allocation for traders

- Fast profit payments within hours

- Multiple accounts allowed per person

- Zero scaling phase requirement

- Low-cost evaluation program available

Company Overview

Sure Leverage Funding stands out as a modern prop trading firm catering to traders of all experience levels. Established with the mission to provide accessible funding solutions, they offer a range of challenge programs designed to identify disciplined and profitable traders. What makes Sure Leverage Funding unique is their balanced approach to trading rules – strict enough to maintain professionalism but flexible enough to accommodate different trading styles.

The company provides funding opportunities ranging from $10,000 to $200,000, with clear pathways for scaling up account sizes after demonstrating consistent performance. Their two-phase evaluation process (Challenge and Verification) serves as a reliable method to identify traders capable of managing larger capital responsibly. With competitive profit splits starting at 80:20 and transparent payout systems, Sure Leverage Funding creates an environment where skilled traders can focus on what they do best – executing profitable trading strategies without risking their own capital.

Key Features at a Glance

Challenge Fees

- Standard Challenge – One-time fee ranging from $95 to $845 depending on account size

- Professional Challenge – Higher entry fee ($170-$1,495) with more relaxed trading parameters

- Reset Fee – Discounted fee to restart a challenge after failure (typically 50-60% of original fee)

- No monthly subscription fees once funded – Pure profit-sharing model

Account Types

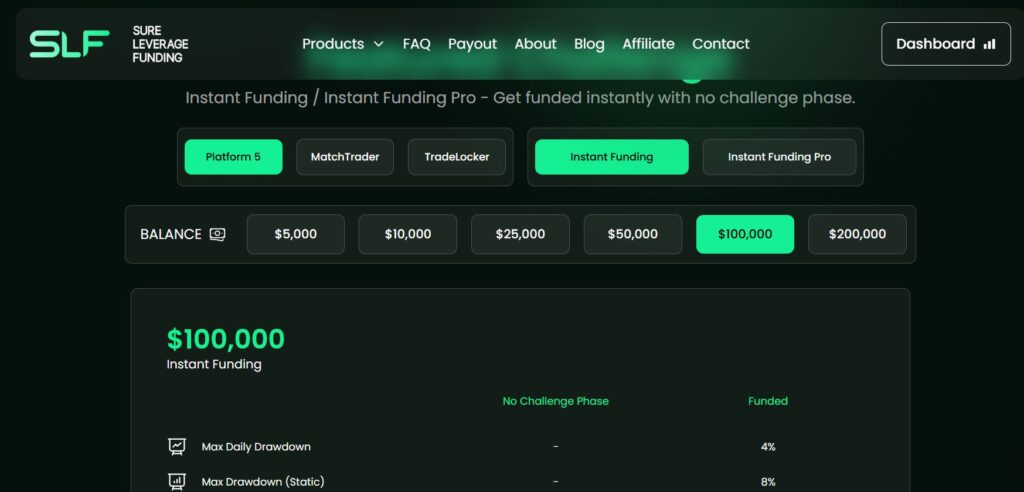

- Standard Challenge: Balanced rules with 8% profit target and 5% daily/10% maximum drawdown limits

- Professional Challenge: More flexibility with 10% profit target and 8% daily/12% maximum drawdown limits

- Funded Account: Live trading account after successful challenge completion with profit splits

- Scaled Account: Increased capital allocation after demonstrating consistent performance

Profit Split Options

- Initial Profit Split: 80:20 – Traders receive 80% of profits generated

- Loyalty Split: 85:15 – Available after consistent performance milestones

- Elite Split: 90:10 – Reserved for top-performing traders after significant consistency

- Monthly Payout Schedule: Regular profit distribution on set dates each month

Account Sizes

- $10,000: Entry-level account with $95-$170 challenge fee depending on program type

- $25,000: Mid-tier account perfect for experienced retail traders

- $50,000: Professional-level account for established trading strategies

- $100,000: High-capacity account for serious traders

- $200,000: Maximum initial account size for proven trading professionals

Trading Platforms

- MetaTrader 4: Classic trading platform with extensive indicator support and EA compatibility

- MetaTrader 5: Advanced multi-asset platform with enhanced features and improved execution

- TradingView: Web-based charting platform with social features and advanced analytics

- Custom Dashboard: Proprietary tracking system for monitoring account metrics and performance

Financial Markets

- Forex: Major, minor, and exotic currency pairs with competitive spreads

- Indices: Global stock indices including US30, S&P500, NASDAQ, and international markets

- Commodities: Energy, metals, and agricultural products with standardized contract sizes

- Cryptocurrencies: Major digital assets with extended trading hours

- Stocks: Select equities from major global exchanges

Challenge Programs Detail

Standard Challenge

| Feature | Challenge Phase | Verification Phase |

|---|---|---|

| Duration | 30 days | 60 days |

| Profit Target | 8% | 5% |

| Daily Drawdown | 5% | 5% |

| Maximum Drawdown | 10% | 10% |

| Minimum Trading Days | 10 days | 10 days |

Professional Challenge

| Feature | Challenge Phase | Verification Phase |

|---|---|---|

| Duration | No time limit | No time limit |

| Profit Target | 10% | 5% |

| Daily Drawdown | 8% | 8% |

| Maximum Drawdown | 12% | 12% |

| Minimum Trading Days | 5 days | 5 days |

Challenge Specifications

- Max Allocation: Up to $200,000 initial funding with scaling opportunities up to $1,000,000

- Scaling: 25% increase in account size after every 3 profitable months with consistent performance

- Trading Competitions: Monthly contests with additional cash prizes and account upgrades

- Free Trial: 7-day demo evaluation available for new traders to test the platform

- Profit Targets: Reasonable targets of 8-10% for Challenge and 5% for Verification phases

- Drawdown Structure:

- Daily: 5-8% daily drawdown limit based on account type

- Maximum: 10-12% overall account drawdown limit

- Trailing: Dynamic drawdown measurement from highest account equity point

Trading Rules and Requirements

- No hedging or taking opposite positions simultaneously

- No holding trades during major economic news releases unless positions are open at least 10 minutes before the event

- Maximum position size of 5% account margin per trade

- Weekend holding permitted with reduced lot sizes (max 2% of account margin)

- Minimum trading activity requirements (5-10 trading days based on program)

- No trading through third-party copy trading services or EAs without approval

- Consistency in trading style between evaluation and funded accounts

Company Information

- Operating since 2019 with headquarters in London, UK

- Regulated broker partnerships for trade execution

- 24/5 customer support via live chat, email, and phone

- Educational resources including webinars, trading guides, and market analysis

- International trader community with over 15,000 active users

- Multiple language support for global accessibility

Payout Methods

- Bank Wire Transfer (3-5 business days)

- Bitcoin/Crypto transfers (24-48 hours)

- PayPal (1-2 business days)

- Skrill/Neteller (24-48 hours)

- Wise (formerly TransferWise) (2-3 business days)

- Minimum payout threshold: $100

Trading Commissions

- Forex: $7 per round-turn lot (100,000 units)

- Indices: $4 per contract

- Commodities: $5 per contract

- Cryptocurrencies: 0.05% per side

- Stocks: $0.02 per share with $1 minimum

IP Rules

- VPN usage permitted after initial registration (must use same country)

- Maximum of 2 different IP addresses allowed per account

- Multiple accounts must be registered under unique email addresses

- Location verification required for initial withdrawal processes

- Desktop trading preferred, mobile trading permitted with stable connections

Video Review

Sure Leverage Funding Review

Comprehensive review of Sure Leverage Funding trading services

Unique Features

Scaling Program

- Accelerated growth path allowing funded traders to increase account size by 25% every quarter

- No additional evaluation required for scaling – based purely on performance

- No cap on maximum account size for consistent performers

Trader Support

- Weekly market analysis webinars with professional traders

- Personalized performance feedback and strategy consultation

- Discord community with dedicated channels for different trading styles

- Trade psychology coaching and risk management workshops

Why Choose Sure Leverage Funding?

Sure Leverage Funding differentiates itself from other prop firms through its balanced approach to trader evaluation and ongoing support. Their rules are designed to identify disciplined traders while allowing enough flexibility for various trading methodologies to succeed.

Key advantages include:

- Transparent evaluation process with reasonable profit targets and risk parameters

- Unlimited time in the Professional Challenge program – trade at your own pace

- Competitive 80:20 profit split from day one, increasing to 90:10 for consistent performers

- Comprehensive scaling program allowing account growth up to $1M

- Multi-platform support including MT4, MT5, and TradingView integration

- Educational resources and community support for trader development

- Fast and reliable payouts through multiple payment methods

There are no reviews yet.