Bright Funded – Firm Review

- Premier platform for aspiring traders

- Quick payout structure benefits professionals

- Cutting-edge tools enhance performance

- No complex rules restrict trading

- Personalized assistance for trader success

#

Company Overview

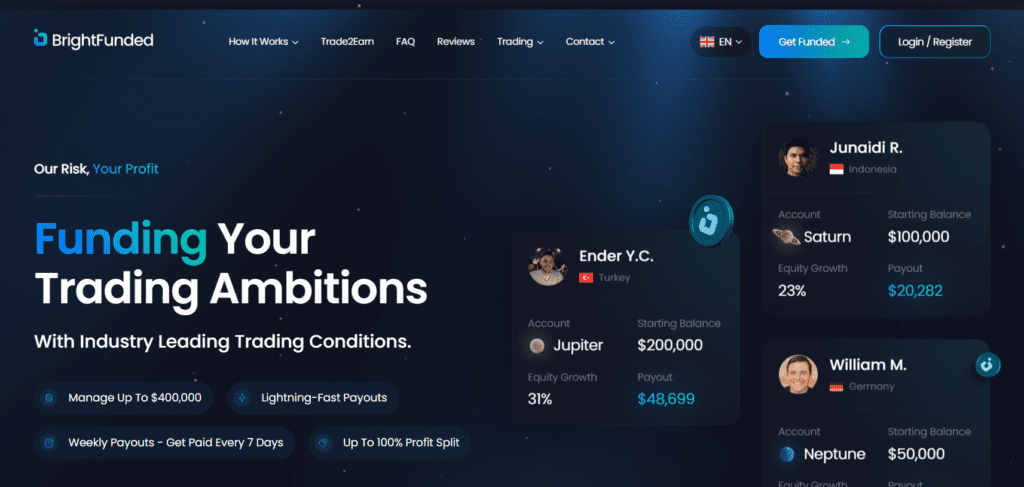

Bright Funded is a modern proprietary trading firm that provides traders with the opportunity to access funded trading accounts after successfully completing their evaluation process. Founded with the vision of empowering traders worldwide, Bright Funded offers a streamlined two-phase challenge program designed to identify disciplined and profitable trading strategies. What sets Bright Funded apart is their competitive fee structure, generous profit splits, and diverse account options catering to both novice and experienced traders.

The firm supports trading across multiple financial markets including forex, indices, commodities, and cryptocurrencies, providing traders with ample opportunities to demonstrate their skills. Their user-friendly dashboard and responsive customer support create a smooth experience for traders throughout their journey from challenge participant to funded trader. With transparent rules and regular payouts, Bright Funded has established itself as a reliable option in the prop trading industry.

Key Features at a Glance

Challenge Fees

- Standard Challenge – One-time fee that varies by account size, starting from $49 for smaller accounts

- Professional Challenge – Higher one-time entry fee with more flexible trading parameters and faster evaluation

- Reset Option – Affordable fee to restart a challenge if trading objectives aren’t met

- Free Demo Account – Available for testing platform compatibility before committing

Account Types

- Standard Account: Two-phase evaluation with balanced trading objectives suitable for most traders

- Professional Account: Accelerated evaluation with more flexible trading parameters for experienced traders

- Funded Account: Live trading account provided after successful completion of the verification phase

- Scaling Account: Opportunity to increase account size based on consistent performance

Profit Split Options

- Standard Profit Split: 80% for traders / 20% for Bright Funded on all funded accounts

- Scaling Profit Split: Potential to increase to 90% profit share after consistent performance

- First Payout: Initial profit withdrawals available after first profitable month

- Regular Payouts: Bi-weekly profit withdrawal options after initial payout

Account Sizes

- $5,000: Entry-level account with lower challenge fee, ideal for beginners

- $10,000: Popular mid-tier option balancing account size and challenge fee

- $25,000: Professional account for serious traders seeking higher profit potential

- $50,000: Advanced account size for experienced traders with proven strategies

- $100,000: Premium account offering maximum capital allocation for elite traders

- $200,000: Highest tier available for professional traders with extensive experience

Trading Platforms

- MetaTrader 4 (MT4): Industry-standard platform with extensive technical analysis tools and indicators

- MetaTrader 5 (MT5): Advanced platform with enhanced features, additional timeframes, and more technical indicators

- Custom Dashboard: Proprietary system for tracking account metrics, trading objectives, and progress

Financial Markets

- Forex: Major, minor, and exotic currency pairs with competitive spreads

- Indices: Global stock market indices including US30, S&P 500, NASDAQ, and major European indices

- Commodities: Energy products (crude oil, natural gas), precious metals (gold, silver), and agricultural products

- Cryptocurrencies: Major digital assets including Bitcoin, Ethereum, and other popular altcoins

Challenge Programs Detail

Standard Challenge

| Feature | Challenge Phase | Verification Phase |

|---|---|---|

| Duration | No time limit | No time limit |

| Profit Target | 8% | 5% |

| Daily Drawdown | 5% | 5% |

| Maximum Drawdown | 10% | 10% |

| Minimum Trading Days | 5 days | 5 days |

Professional Challenge

| Feature | Challenge Phase | Verification Phase |

|---|---|---|

| Duration | No time limit | No time limit |

| Profit Target | 10% | 5% |

| Daily Drawdown | 6% | 6% |

| Maximum Drawdown | 12% | 12% |

| Minimum Trading Days | 4 days | 4 days |

Challenge Specifications

- Max Allocation: Up to $200,000 for qualified traders, with potential for scaling based on performance

- Scaling: Account size can be increased by up to 25% after demonstrating consistent profitability for 3 consecutive months

- Trading Competitions: Monthly challenges with additional cash prizes and opportunities for free account upgrades

- Free Trial: 7-day demo account available to test platform compatibility and trading conditions

- Profit Targets: Range from 8-10% for Challenge phase and 5% for Verification phase, depending on account type

- Drawdown Structure:

- Daily: 5-6% limit from previous day’s closing balance

- Maximum: 10-12% overall account balance drawdown limit

- Trailing: No trailing drawdown, only fixed limits from initial balance

Trading Rules and Requirements

- News trading is allowed, but traders must manage risk appropriately during high volatility events

- Minimum 5 trading days required during both Challenge and Verification phases (4 days for Professional accounts)

- Position holding allowed over weekends with proper risk management

- EAs (Expert Advisors) and automated trading systems are permitted

- Hedging is allowed between different instruments

- No restrictions on trade duration – both scalping and swing trading are acceptable

- Maximum trading lot size based on account size (1 standard lot per $10,000 of account capital)

- Prohibited strategies include arbitrage, latency exploitation, and broker manipulation tactics

Company Information

- Founded in 2020 and headquartered in the United Kingdom

- Offers services globally with traders from over 100 countries

- Support available via email, live chat, and scheduled calls

- Response time typically within 24 hours for most inquiries

- Educational resources including webinars and trading guides

- Active community with regular trader spotlights and success stories

Payout Methods

- Bank Transfer (3-5 business days)

- PayPal (1-2 business days)

- Skrill (1-2 business days)

- Bitcoin/Cryptocurrency (Same day)

- Wise (1-3 business days)

- Minimum payout amount: $50

- Bi-weekly payment schedule once initial profit target is reached

Trading Commissions

- Forex pairs: $7 per lot round turn

- Indices: $7-$10 per lot depending on the specific index

- Commodities: $7-$12 per lot depending on the instrument

- Cryptocurrencies: 0.1% of trade value

- No monthly subscription fees after achieving funded status

- No hidden fees or additional charges during profit withdrawals

IP Rules

- Trading from different IP addresses is permitted with prior notification

- VPN usage allowed but must be disclosed in advance

- Multiple accounts from the same household require separate registration

- Account sharing is strictly prohibited

- Travel notifications should be submitted when trading from a new location

Video Review

Bright Funded Review

Comprehensive review of Bright Funded trading services

Unique Features

Trading Flexibility

- No time limits for completing challenge phases

- Ability to hold positions over weekends with proper risk management

- Support for both manual and automated trading strategies

- News trading allowed with appropriate risk controls

Trader Support

- Dedicated account manager for funded traders

- Educational webinars and trading resources

- Community forums for strategy sharing and networking

- Trade performance analytics dashboard

Economic Advantages

- High profit split (80-90%) compared to industry average

- Account scaling opportunities based on performance

- Competitive one-time challenge fees with no recurring costs

- Multiple payout options with fast processing times

Why Choose Bright Funded?

Bright Funded stands out in the crowded prop firm market by offering a trader-friendly approach that combines flexibility, transparency, and competitive terms. Their evaluation process is designed to identify disciplined traders while allowing enough freedom for various trading styles to succeed.

Key advantages include:

- No time constraints for completing challenges, allowing traders to demonstrate skill without unnecessary pressure

- Generous 80% profit split with potential to increase to 90% for consistent performers

- Diverse range of account sizes from $5,000 to $200,000 to suit different experience levels and capital requirements

- Allowance for weekend position holding and news trading with proper risk management

- Support for both manual trading and automated strategies (EAs)

- Bi-weekly payouts with multiple withdrawal options

- Account scaling program that rewards consistent performance

- Transparent rules with no hidden restrictions or fine print surprises

There are no reviews yet.